Asset Allocation: How Diversification Balances Returns and Risks

In today’s fast-changing financial markets, investors are rethinking their strategies. The focus is shifting back to a principle as old as investing itself — asset allocation. This approach is about…

Headlines

Your Trusted Source for Accurate and Timely Updates!

Most Read This Week

15 Bank Holidays in August 2025: Plan Your Finances in Advance!

If you’ve ever stood in front of a closed bank gate, fuming because you forgot it was a holiday — you’re not alone. But don’t worry, we’ve got your back.…

Think Before You Sign: 5 Big Mistakes to Avoid While Taking a Home Loan

Buying a house is a dream. Taking a home loan? Often a long-term financial commitment that…

Boost Your CIBIL Score Fast: 10 Practical Steps That Actually Work (No Jargon, Just Results)

Your CIBIL score is more than just a number — it’s your financial reputation. Whether…

SBI’s ₹25,000 Cr Share Sale: India’s Biggest Equity Raise by a Bank in 8 Years – Explained Simply

In a major development that marks a new chapter in Indian banking history, the State Bank…

Just for You

Home Loan Leader: How SBI Reclaimed the Crown from HDFC Bank

The State Bank of India (SBI) has just reclaimed the title of Home Loan Leader.…

Insights and Tips for Robust Health and Vitality

Music expresses feeling and thought, without language. It was below and before speech, and it…

Discovering Harmony in Mental, Emotional, and Physical Health

Modern technology has become a total phenomenon for civilization, the defining force of a new…

Crafting Daily Habits for Long-term Health and Happiness

Modern technology has become a total phenomenon for civilization, the defining force of a new…

Unlock the Pulse of the Present

Must Read

SBI Q1 Profits 2025: Big Growth, Small Margin Dip

The first quarter of FY26 brought strong financial results for the State Bank of India (SBI). The numbers show growth…

Examining the Influence of Media and Rhetoric on Public Opinion

We are just an advanced breed of monkeys on a minor planet of a very average star. But we can…

Exploring the Impact of Identity Politics on Global Governance

We are just an advanced breed of monkeys on a minor planet of a very average star. But we can…

Pioneering Role of Technology in Modern Military Strategies

We are just an advanced breed of monkeys on a minor planet of a very average star. But we can…

Dearness Allowance Hiked to 21.13% from August 2025: What It Means for Bank Employees and Pensioners

💰 Big news for India’s banking workforce! The Dearness Allowance (DA) for bank officers has been revised to 21.13% for the quarter August 2025 to October 2025. This increment, effective…

SBI Clerk Recruitment 2025: Apply for 6500 Vacancies – Everything You Need to Know

📰 Introduction The State Bank of India (SBI), India’s largest public sector bank, has opened the doors to SBI Clerk Recruitment 2025, announcing a whopping 6500 vacancies across the country.…

NSDL IPO Explained: Is It the Right Long-Term Investment in 2025?

India’s capital market is buzzing again, and this time it’s because of NSDL’s IPO — a move that promises a long-term growth play in an evolving financial ecosystem. If you’ve…

When Work Pressure Turns Fatal: Bank Manager’s Suicide Sheds Light on Mental Health Crisis in Banking Sector

🧠In a tragic and heart-wrenching incident from Baramati in Pune district, a 52-year-old branch manager of Bank of Baroda, Shivshankar Mitra, died by suicide inside his own bank branch. Mitra,…

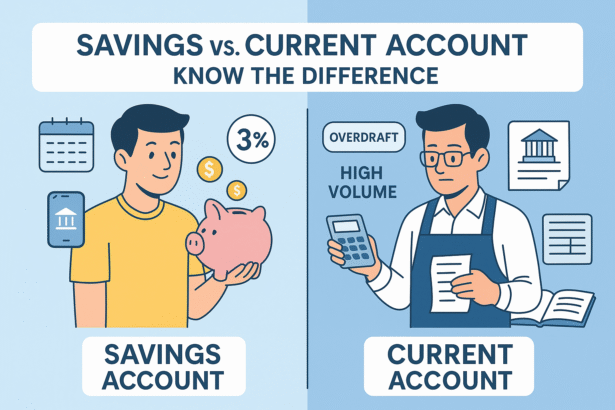

Savings Account vs. Current Account – What’s the Real Difference? Explained with Easy Examples

When it comes to banking, the most basic decision you’ll face is: Should I open a Savings Account or a Current Account?This question seems simple, but it holds the key to…

10 Smart Ways to Save Money and Grow Your Wealth

Saving money and growing wealth are essential for financial security and long-term prosperity. However, many people struggle to balance spending and saving. By implementing smart financial habits, you can secure…

Catching Every Beat of World News as it Happens

Modern technology has become a total phenomenon for civilization, the defining force of a new social order in which efficiency is no longer an option but a necessity imposed on…

Embark on Mystical Adventures in Uncharted Territories

If you are a guest on a spring wedding it's the perfect opportunity to refresh your wardrobe. We've picked out 15 wedding guest dresses for spring.

Enhancing Your Explorations with Travel Tech Breakthroughs

The summer is a fun and energetic time of year, and a favorite time to travel. It’s also the perfect time to wear your boldest and brightest clothes, try new…

Gastronomic Delights Explored in Culinary Expeditions Around the World

And then there is the most dangerous risk of all, the risk of spending your life not doing what you want on the bet you can buy yourself the freedom…

Discovering Top Travel Destinations Revealed for 2024

We are just an advanced breed of monkeys on a minor planet of a very average star. But we can understand the Universe. That makes us something very special.

Mini Games

Wordle

Guess words from 4 to 11 letters and create your own puzzles.

Letter Boxed

Create words using letters around the square.

Magic Tiles

Match elements and keep your chain going.

Chess Reply

Play Historic chess games.